Modular, Intent-Driven Infrastructure Bridging

TradFi's Confidence with DeFi's Composability

Incubated with Asia's

leading Fintech

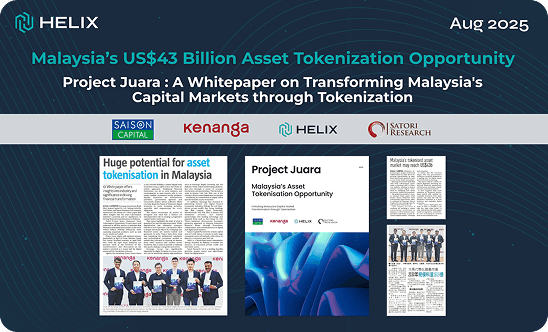

Recognized as an Industry Leader

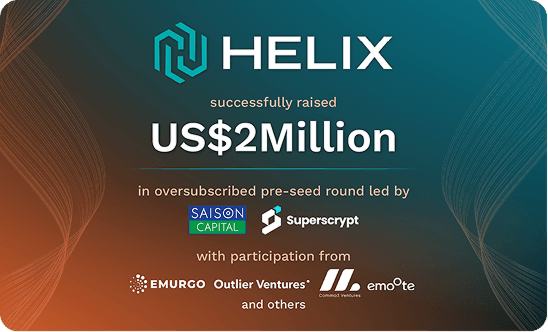

Backed By

And Select Angels From

Backed By

HelixOrchestration Layer

The Building Blocks for Intent-Driven, Scalable, and Abstracted RWA-Powered Finance.

HelixHub

The Omni-Chain, Composable Gateway To Institutional-Grade RWAFi Built On The Helix Orchestration Layer

Multi-Strategy RWA Yields

Sustainable Yields from RWAs. DeFi users can unlock yield products, originated and attested by TradFi Institutions.

Omni-Chain Composability

Helix Hub enables seamless multi-chain access by unifying liquidity and yield across the RWA and DeFi ecosystem.

Transparent Attestations

Helix Hub delivers transparency through verified attestations that validate each vault's underlying assets and yield sources.

Real World Assets (RWAs)

The Orchestration Advantage

Helix's intent-driven orchestration layer doesn't just tokenize assets, it orchestrates their full lifecycle. By combining issuance, compliance, liquidity, user experience and distribution into one modular framework, Helix ensures RWAs can scale seamlessly across ecosystems.

Gateway through Helix Hub

For users, Helix Hub opens direct access to institutional-grade opportunities: money markets, private credit, and structured strategies. The USHD stablecoin acts as the entry point into the Hub, enabling participation across the full risk–return curve.

Secure and Compliant by Design

RWAs remain safely held off-chain, eliminating honeypots and reducing exploit risks, while their on-chain representations remain fully composable across DeFi.

Omni-Chain Composability

Helix's omni-chain architecture ensures smooth integration across protocols, DAOs, treasuries, and ecosystems. Assets can move seamlessly across strategies and partners, combining the programmability of DeFi with the trust of TradFi.

Our Partners

Our Partners

You ask, we answer Frequently Asked Questions | ||